|

|

|

|

|

|

|

|

|

|||

|

|

|

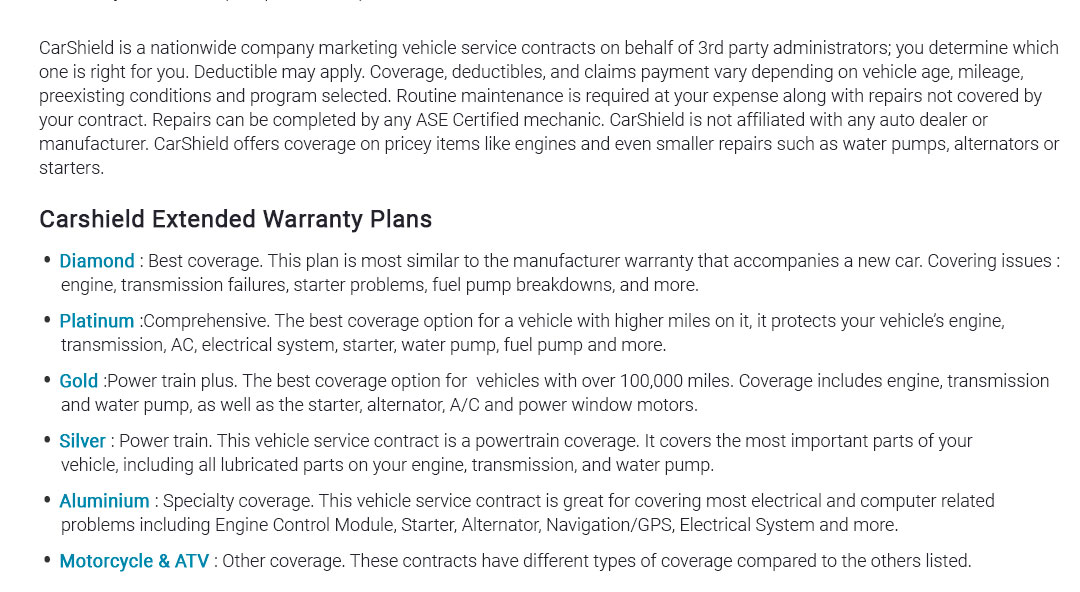

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

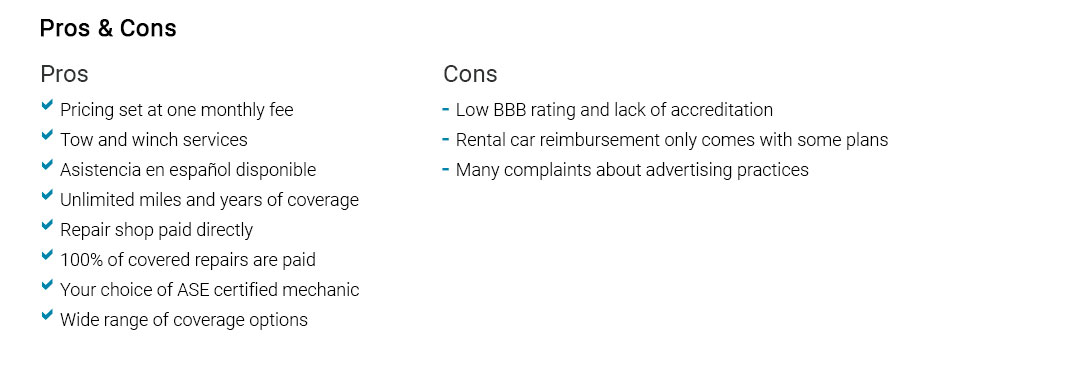

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

superior protection auto warranty field guide for repeat ownersI've renewed this coverage twice now, and each round sharpened my checklist. The goal stays simple: protect the wallet, keep the car on the road, and make claims boringly smooth. Trust and Savings are the two dials I keep turning. What I verify before renewing

Real-world momentLast spring, 70 miles from home, my camshaft position sensor died. One call, tow authorized, and the claims rep spoke directly with the shop; parts and labor were covered after my $100 deductible. I saved over $450 and got back on the road by dinner. That's the kind of quiet reliability I'm paying for. Coverage tiers in plain terms

I match tier to the car's risk zones: turbo, direct injection, air suspension, infotainment - higher complexity nudges me toward exclusionary because surprise electronics add up fast. Cost control levers I actually use

Pragmatic caveat: no warranty covers neglect. Missed oil changes, undocumented maintenance, or non-approved mods can sink a claim. Also expect prior authorization before teardown - shops know this, but I still call first. How I file a smooth claim

Signals that build trust

Is it worth it for you?I run a quick break-even: average annual repair risk (based on model history and my shop's rates) vs premium plus expected deductibles. High-mileage commuters and out-of-warranty owners usually see Savings; brand-new cars under factory coverage typically don't. If the math is close, I look at volatility - one transmission bill can tilt the equation. To wrap, a superior protection auto warranty isn't magic, but with the right deductible, clear exclusions, and a cooperative shop network, it buys steady costs and fewer headaches. I renew when the numbers support it - and they often do. https://www.facebook.com/EnduranceWarranty/videos/the-superior-plan/668321791582282/

The Superior Plan. Superior provides complete protection with extensive component coverage for total peace of mind. http://superiorprotectionplanwarranty.autowarrantyyjq.com/

Superior Protection Plan Warranty - Extended car warranty can help you to stop paying for unexpected car repair. We offer auto warranty with competitive ... https://www.bbb.org/us/az/tucson/profile/security/superior-protection-services-1286-20109265

File an Auto Warranty Complaint - Sign up for Scam Alerts - Frequently Asked ...

|